All Categories

Featured

Table of Contents

- – What Is Annual Renewable Term Life Insurance? ...

- – What is Short Term Life Insurance Coverage Like?

- – What is 30-year Level Term Life Insurance and...

- – What is What Does Level Term Life Insurance M...

- – What is 10-year Level Term Life Insurance? T...

- – Is Term Life Insurance For Couples a Good Op...

If George is diagnosed with a terminal health problem during the initial plan term, he possibly will not be qualified to restore the policy when it expires. Some policies supply guaranteed re-insurability (without proof of insurability), however such functions come at a greater expense. There are a number of sorts of term life insurance policy.

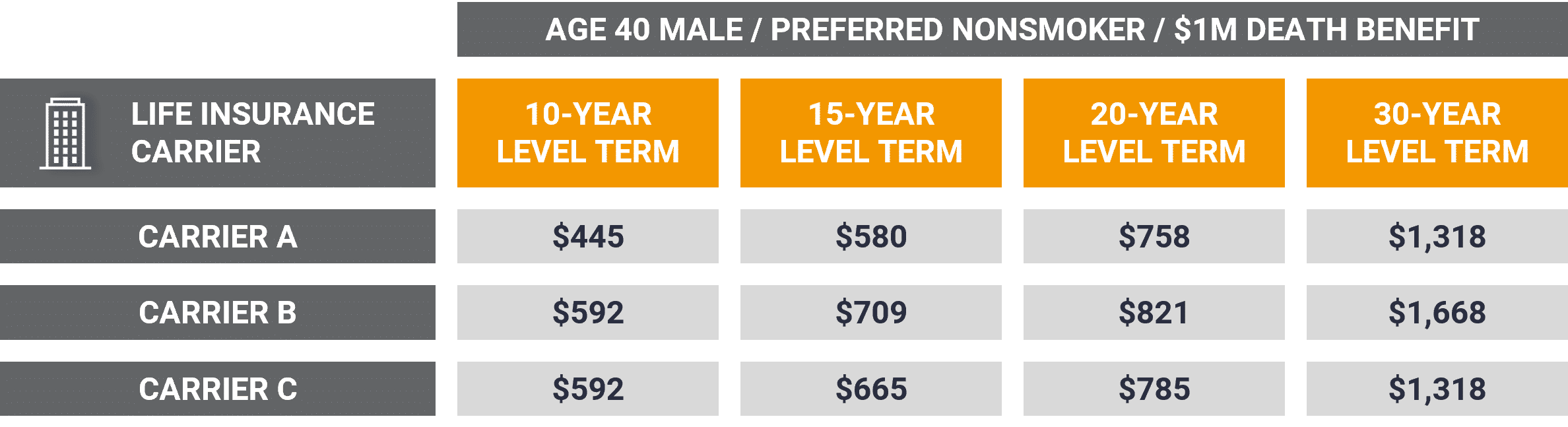

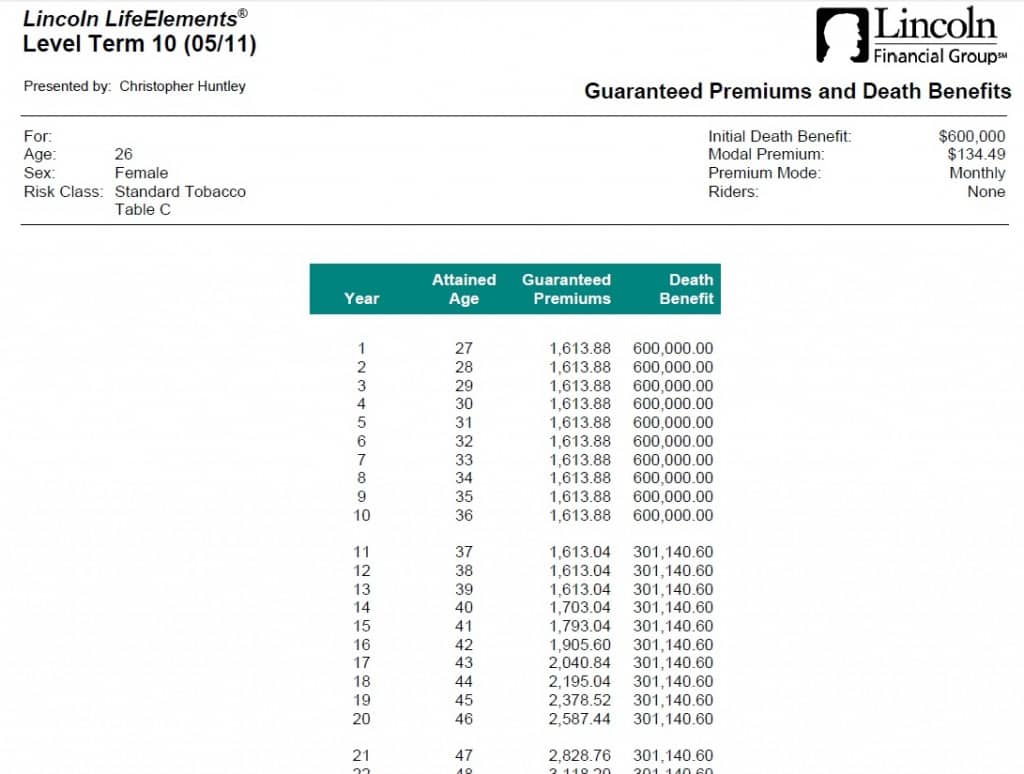

Usually, most firms provide terms ranging from 10 to thirty years, although a couple of offer 35- and 40-year terms. Level-premium insurance has a set regular monthly settlement for the life of the policy. Most term life insurance policy has a degree premium, and it's the kind we've been describing in many of this write-up.

Term life insurance is attractive to young people with kids. Moms and dads can acquire substantial protection for an affordable, and if the insured dies while the plan is in impact, the household can count on the survivor benefit to replace lost earnings. These plans are also well-suited for individuals with growing family members.

What Is Annual Renewable Term Life Insurance? The Complete Overview?

The appropriate choice for you will certainly depend upon your demands. Here are some points to consider. Term life plans are suitable for people that desire significant protection at an affordable. Individuals who own entire life insurance coverage pay more in costs for much less protection however have the protection of understanding they are safeguarded for life.

The conversion cyclist must allow you to transform to any kind of permanent plan the insurance firm supplies without limitations. The main features of the cyclist are keeping the initial wellness score of the term plan upon conversion (also if you later have health and wellness issues or come to be uninsurable) and making a decision when and just how much of the coverage to convert.

Naturally, total premiums will certainly increase dramatically since whole life insurance policy is a lot more costly than term life insurance policy. The advantage is the guaranteed approval without a medical test. Clinical problems that establish throughout the term life duration can not trigger costs to be increased. The business may require minimal or full underwriting if you want to add extra cyclists to the brand-new policy, such as a long-lasting care motorcyclist.

What is Short Term Life Insurance Coverage Like?

Entire life insurance policy comes with substantially greater month-to-month premiums. It is implied to give insurance coverage for as lengthy as you live.

It relies on their age. Insurance policy firms established an optimum age restriction for term life insurance coverage policies. This is normally 80 to 90 years of ages but might be higher or reduced depending on the company. The costs likewise increases with age, so a person matured 60 or 70 will certainly pay substantially more than somebody decades more youthful.

Term life is somewhat similar to automobile insurance. It's statistically not likely that you'll require it, and the premiums are cash away if you do not. If the worst happens, your family members will get the benefits.

What is 30-year Level Term Life Insurance and Why Is It Important?

Generally, there are two sorts of life insurance plans - either term or irreversible strategies or some combination of the 2. Life insurance firms use different kinds of term plans and conventional life plans along with "interest delicate" products which have actually come to be much more prevalent because the 1980's.

Term insurance coverage supplies defense for a given time period. This duration might be as short as one year or offer protection for a particular number of years such as 5, 10, twenty years or to a defined age such as 80 or in some instances approximately the earliest age in the life insurance policy mortality tables.

What is What Does Level Term Life Insurance Mean? Explained in Simple Terms?

Currently term insurance policy prices are extremely affordable and amongst the most affordable traditionally experienced. It ought to be kept in mind that it is a widely held idea that term insurance is the least costly pure life insurance policy coverage offered. One needs to assess the policy terms meticulously to choose which term life alternatives appropriate to fulfill your particular situations.

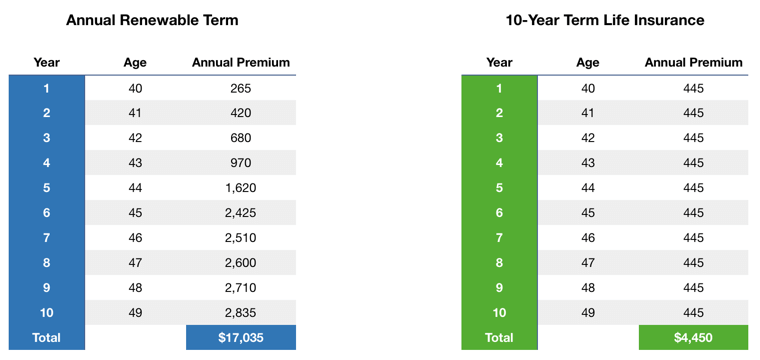

With each new term the costs is raised. The right to restore the plan without evidence of insurability is an important advantage to you. Or else, the risk you take is that your wellness might wear away and you may be not able to get a plan at the very same rates and even in all, leaving you and your beneficiaries without coverage.

Navigating life insurance options can be overwhelming, especially with so many policies available. This is where working with an experienced insurance broker or agent makes all the difference. Unlike insurance agents tied to a single provider, brokers offer access to multiple life insurance options, helping you find the most suitable policy for your needs - whole life insurance brokers. Whether it’s term life insurance for temporary coverage, whole life insurance for lifelong protection, or universal life for long-term growth, an insurance broker evaluates your unique goals and compares providers to secure the best coverage at competitive rates

For families, policies like final expense insurance, mortgage protection, and accidental death coverage offer tailored solutions to protect loved ones. Business owners can also benefit from key person insurance, ensuring continuity in the event of an unforeseen loss. With life insurance policies offering living benefits or instant coverage, brokers simplify the decision-making process and ensure your financial priorities are met.

By choosing the right insurance broker, you gain expert guidance, access to personalized recommendations, and the confidence of knowing your family or business is secure. Contact an insurance broker today to explore tailored life insurance options and secure peace of mind for the future.

The length of the conversion duration will differ depending on the kind of term policy purchased. The costs price you pay on conversion is typically based on your "current acquired age", which is your age on the conversion day.

Under a level term policy the face quantity of the policy continues to be the very same for the entire period. Frequently such policies are offered as home loan defense with the amount of insurance lowering as the equilibrium of the home loan lowers.

Traditionally, insurance companies have actually not had the right to alter costs after the plan is offered. Given that such policies may continue for several years, insurance firms need to use conventional death, interest and expense rate price quotes in the premium calculation. Flexible premium insurance, nevertheless, enables insurance providers to offer insurance at reduced "current" premiums based upon less traditional presumptions with the right to change these premiums in the future.

What is 10-year Level Term Life Insurance? The Key Points?

While term insurance coverage is developed to provide defense for a specified time period, permanent insurance policy is designed to offer insurance coverage for your whole life time. To keep the costs rate level, the costs at the more youthful ages surpasses the real cost of protection. This added premium develops a book (cash value) which aids spend for the policy in later years as the cost of defense surges over the premium.

The insurance policy firm invests the excess premium bucks This kind of plan, which is in some cases called cash money worth life insurance coverage, produces a financial savings component. Money values are crucial to a long-term life insurance coverage plan.

Occasionally, there is no relationship in between the size of the cash worth and the costs paid. It is the money worth of the policy that can be accessed while the insurance policy holder is to life. The Commissioners 1980 Criterion Ordinary Mortality Table (CSO) is the existing table made use of in calculating minimal nonforfeiture worths and policy reserves for normal life insurance policy plans.

Is Term Life Insurance For Couples a Good Option for You?

Numerous irreversible plans will have stipulations, which specify these tax needs. Typical entire life policies are based upon lasting estimates of expense, interest and death.

Table of Contents

- – What Is Annual Renewable Term Life Insurance? ...

- – What is Short Term Life Insurance Coverage Like?

- – What is 30-year Level Term Life Insurance and...

- – What is What Does Level Term Life Insurance M...

- – What is 10-year Level Term Life Insurance? T...

- – Is Term Life Insurance For Couples a Good Op...

Latest Posts

Best Funeral Cover For Parents

Burial Insurance Cost For Seniors

Forethought Final Expense Insurance

More

Latest Posts

Best Funeral Cover For Parents

Burial Insurance Cost For Seniors

Forethought Final Expense Insurance