All Categories

Featured

Table of Contents

Navigating life insurance options can be overwhelming, especially with so many policies available. This is where working with an experienced insurance broker or agent makes all the difference. Unlike insurance agents tied to a single provider, brokers offer access to multiple life insurance options, helping you find the most suitable policy for your needs - how to choose life insurance with an agent. Whether it’s term life insurance for temporary coverage, whole life insurance for lifelong protection, or universal life for long-term growth, an insurance broker evaluates your unique goals and compares providers to secure the best coverage at competitive rates

For families, policies like final expense insurance, mortgage protection, and accidental death coverage offer tailored solutions to protect loved ones. Business owners can also benefit from key person insurance, ensuring continuity in the event of an unforeseen loss. With life insurance policies offering living benefits or instant coverage, brokers simplify the decision-making process and ensure your financial priorities are met.

By choosing the right insurance broker, you gain expert guidance, access to personalized recommendations, and the confidence of knowing your family or business is secure. Contact an insurance broker today to explore tailored life insurance options and secure peace of mind for the future.

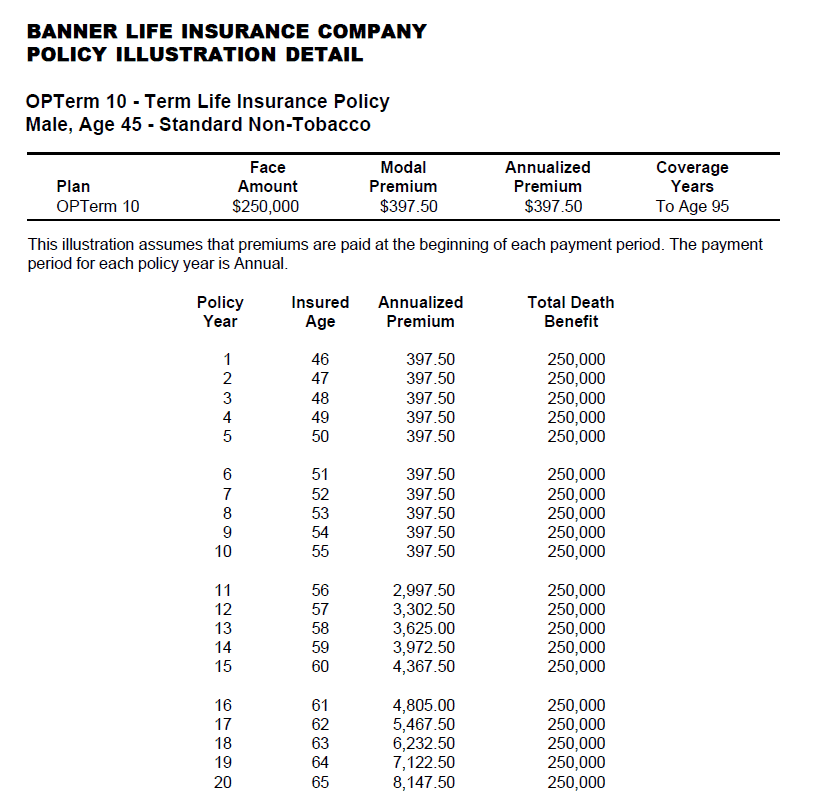

That generally makes them a more affordable option permanently insurance policy coverage. Some term policies may not maintain the costs and survivor benefit the exact same gradually. You do not wish to wrongly think you're purchasing level term coverage and after that have your death benefit adjustment later. Many individuals obtain life insurance policy protection to assist financially secure their enjoyed ones in situation of their unanticipated fatality.

Or you may have the choice to transform your existing term insurance coverage into an irreversible plan that lasts the remainder of your life. Numerous life insurance plans have prospective benefits and downsides, so it's essential to comprehend each prior to you decide to buy a policy.

As long as you pay the premium, your beneficiaries will certainly get the fatality benefit if you die while covered. That stated, it is essential to keep in mind that most plans are contestable for two years which implies insurance coverage could be retracted on death, must a misstatement be discovered in the app. Plans that are not contestable often have actually a graded survivor benefit.

Costs are generally reduced than entire life plans. You're not locked right into an agreement for the rest of your life.

And you can't squander your policy during its term, so you won't get any type of economic gain from your previous protection. Just like other sorts of life insurance policy, the cost of a degree term plan depends on your age, protection requirements, employment, way of living and health and wellness. Normally, you'll find much more budget-friendly protection if you're more youthful, healthier and much less dangerous to guarantee.

Reliable Level Term Life Insurance Meaning

Since level term costs remain the very same for the period of protection, you'll recognize specifically just how much you'll pay each time. Level term insurance coverage additionally has some versatility, enabling you to tailor your policy with additional features.

You may have to fulfill particular conditions and credentials for your insurer to pass this cyclist. There additionally could be an age or time restriction on the insurance coverage.

The survivor benefit is commonly smaller, and protection typically lasts up until your youngster turns 18 or 25. This rider might be an extra cost-efficient means to aid guarantee your kids are covered as bikers can commonly cover numerous dependents simultaneously. When your youngster ages out of this coverage, it may be feasible to convert the cyclist right into a new policy.

When contrasting term versus irreversible life insurance policy. increasing term life insurance, it is necessary to keep in mind there are a couple of different kinds. The most typical kind of irreversible life insurance policy is whole life insurance policy, yet it has some key differences compared to level term insurance coverage. Here's a fundamental overview of what to consider when contrasting term vs.

Entire life insurance policy lasts for life, while term insurance coverage lasts for a specific duration. The premiums for term life insurance policy are generally less than whole life insurance coverage. Nonetheless, with both, the costs continue to be the very same for the period of the plan. Whole life insurance policy has a money value element, where a portion of the costs may grow tax-deferred for future needs.

Among the main features of level term coverage is that your costs and your death advantage don't transform. With lowering term life insurance policy, your premiums remain the same; nonetheless, the survivor benefit quantity gets smaller in time. For instance, you might have insurance coverage that begins with a survivor benefit of $10,000, which could cover a home mortgage, and after that every year, the death advantage will decrease by a set quantity or percent.

As a result of this, it's usually a more inexpensive kind of level term insurance coverage. You may have life insurance policy with your employer, yet it may not be enough life insurance coverage for your requirements. The very first step when getting a plan is establishing just how much life insurance coverage you need. Think about elements such as: Age Household dimension and ages Work status Earnings Debt Lifestyle Expected last expenditures A life insurance policy calculator can help determine just how much you need to begin.

After selecting a policy, complete the application. For the underwriting procedure, you might need to provide basic personal, wellness, lifestyle and employment information. Your insurance firm will certainly determine if you are insurable and the threat you might provide to them, which is shown in your premium expenses. If you're approved, authorize the paperwork and pay your initial costs.

Reputable Level Premium Term Life Insurance Policies

Ultimately, take into consideration organizing time each year to review your plan. You might desire to update your recipient details if you have actually had any substantial life changes, such as a marriage, birth or separation. Life insurance policy can sometimes feel complex. You don't have to go it alone. As you discover your options, think about reviewing your demands, wants and worries with a monetary professional.

No, level term life insurance policy doesn't have money value. Some life insurance coverage plans have an investment function that enables you to construct cash value gradually. A part of your costs settlements is reserved and can make passion in time, which expands tax-deferred during the life of your protection.

These plans are usually considerably extra costly than term insurance coverage. If you get to completion of your plan and are still to life, the insurance coverage ends. Nonetheless, you have some options if you still desire some life insurance policy protection. You can: If you're 65 and your coverage has gone out, as an example, you might want to buy a new 10-year level term life insurance policy plan.

Quality Guaranteed Issue Term Life Insurance

You might have the ability to transform your term coverage right into a whole life plan that will last for the remainder of your life. Lots of kinds of level term plans are exchangeable. That implies, at the end of your insurance coverage, you can convert some or every one of your policy to whole life coverage.

Degree term life insurance policy is a plan that lasts a collection term usually in between 10 and three decades and includes a level death benefit and degree costs that stay the exact same for the whole time the policy is in result. This suggests you'll understand specifically just how much your payments are and when you'll need to make them, enabling you to budget plan appropriately.

Degree term can be a great option if you're aiming to acquire life insurance policy protection for the very first time. According to LIMRA's 2023 Insurance Barometer Research Study, 30% of all adults in the U.S. need life insurance policy and don't have any type of kind of plan yet. Degree term life is foreseeable and affordable, that makes it among one of the most preferred kinds of life insurance policy.

Latest Posts

Best Funeral Cover For Parents

Burial Insurance Cost For Seniors

Forethought Final Expense Insurance